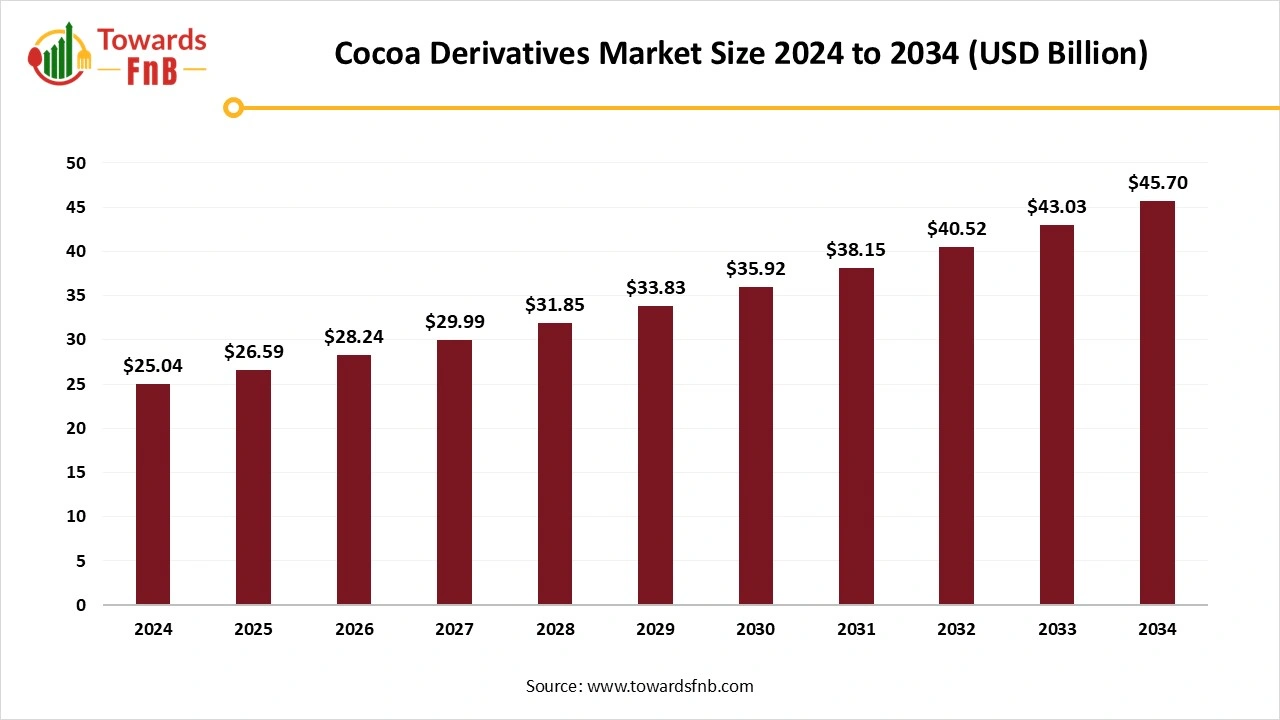

Cocoa Derivative Market Size to Exceed USD 45.70 Billion by 2034, Fueled by Premium Confectionery, Plant-Based, and Clean-Label Demand

According to Towards FnB, the global cocoa derivative market size is calculated at USD 26.59 billion in 2025 and is projected to reach USD 45.70 billion by 2034, expanding at a CAGR of 6.2% from 2025 to 2034. This growth reflects increasing consumer demand for cocoa-based ingredients across food, beverage, and personal care industries worldwide.

Ottawa, Nov. 06, 2025 (GLOBE NEWSWIRE) -- The global cocoa derivative market size stood at USD 25.04 billion in 2024 and is predicted to increase from USD 26.59 billion in 2025 to reach nearly USD 45.70 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to high demand for cocoa-based products, including chocolate, cocoa powder, chocolate spreads, and various other food items. The growing demand for plant-based alternatives is another major factor driving the cocoa industry's growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5526

Data Snapshot

- Base Year: 2024

- 2025 Market Size: USD 26.59 Bn

- 2034 Market Size: USD 45.70 Bn

- 2025–2034 CAGR: 6.2%

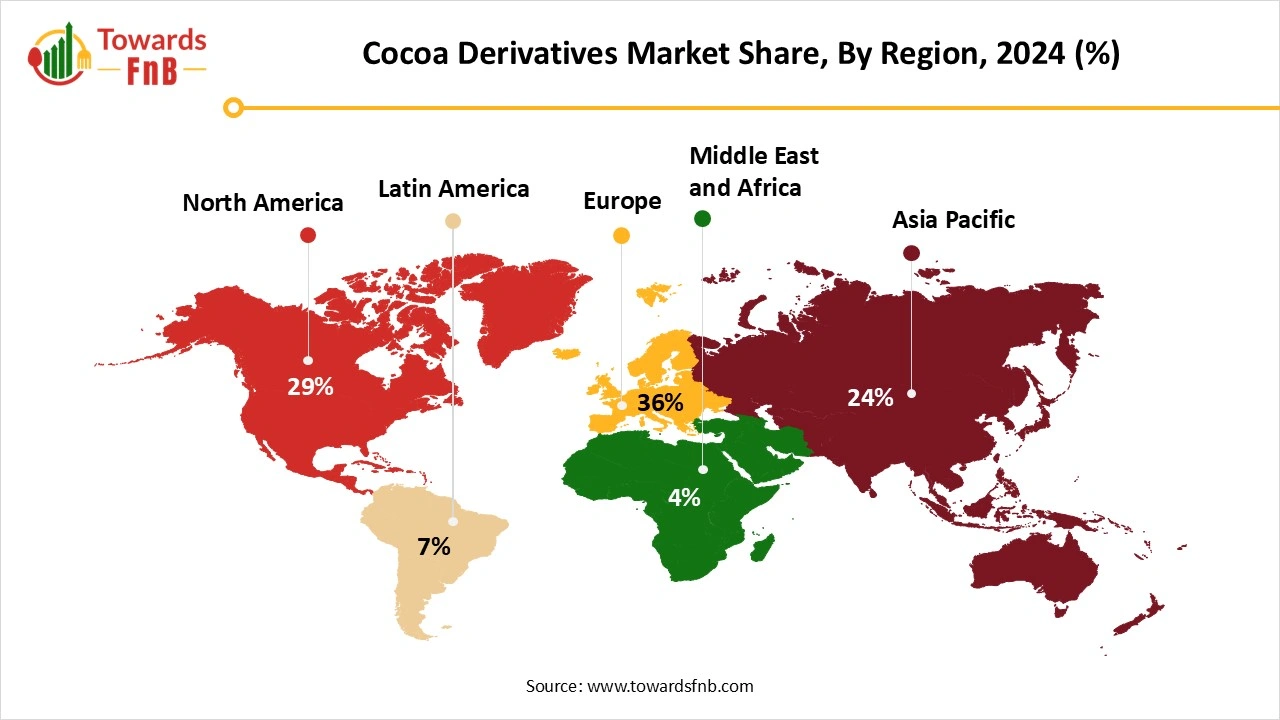

- Largest Region (2024): Europe (36%)

- Fastest-Growing Region: Asia Pacific

- Top Application: Food & Beverage; Fastest-Growing: Personal Care & Cosmetics

“Buyers are looking for flavor consistency and supply assurance amid volatility. We see multi-origin sourcing and AI-assisted quality control improving yields while keeping sensory profiles stable,” said Vidyesh Swar, Principal Consultant at Towards FnB.

Key Highlights of Cocoa Derivative Market

- By region, Europe led the cocoa derivative market with largest share of 36% in 2024, whereas the Asia Pacific is expected to grow in the foreseen period, being the highest manufacturer of baked goods, cookies, ice cream, chocolates, and confectionery.

- By type, the cocoa powder segment captured the maximum share in 2024, whereas the cocoa butter segment is expected to grow in the forecast period.

- By distribution channel, the B2B segment led the cocoa derivative market in 2024, whereas the B2C segment is expected to grow in the forecast period as the segment focuses on connecting the end consumers, manufacturers, and brands directly.

- By application, the food and beverage segment dominated the market in 2024, whereas the personal care and cosmetics segment is expected to grow in the expected timeframe due to the ingredient’s antioxidant and anti-inflammatory properties.

Versatility of Ingredients is helpful for the Expansion of the Cocoa Derivative Industry

The cocoa derivative market is observed to grow due to its high demand in multiple domains such as chocolate and confectionery, bakery, pharmaceutical companies, and even in the manufacturing of personal care products. The cocoa derivatives involve cocoa-based products such as chocolates, cocoa butter, and cocoa beans. These products are available in traditional as well as organic variants, further fueling the growth of the market.

The major usage of cocoa is observed in the food and beverages industry. It is used for making different types of bakery items such as cakes, cookies, chocolates, hot beverages, and various other sweet treats. The ingredient is also utilized for the manufacturing of cosmetics in the form of cocoa butter, which is extracted by using hydraulic technology. The market also has sustainable chocolates made using eco-friendly procedures and ingredients. Hence, such products have a huge consumer base of vegans and plant-based diet followers. High demand for premium and artisanal chocolates and baked products is another major factor for the growth of the market.

Impact of AI in the Cocoa Derivatives Market

Artificial intelligence (AI) is reshaping the cocoa derivatives market by driving innovation, improving supply chain transparency, and enhancing product quality across applications in food, cosmetics, and pharmaceuticals. In agriculture and sourcing, AI-powered tools are helping cocoa producers optimize yield and sustainability. Machine learning models analyze satellite imagery, soil data, and weather patterns to detect diseases like black pod rot, predict harvest times, and manage fertilizer and irrigation use efficiently, reducing waste while ensuring sustainable farming practices. AI also supports traceability by integrating with blockchain technology, enabling real-time tracking of cocoa beans from farm to factory, thus promoting fair trade and ethical sourcing.

AI-driven predictive analytics optimize roasting, grinding, and fermentation processes, ensuring consistency in flavor, aroma, and nutrient retention. Computer vision systems monitor quality by detecting impurities, defects, or inconsistencies in cocoa beans and derivatives such as butter, powder, and liquor, maintaining compliance with global food safety standards. AI analyzes consumer preferences and health data to help companies innovate new cocoa-based formulations, such as low-sugar, functional, or antioxidant-rich products. AI-powered sentiment analysis also identifies emerging trends in premium, organic, and sustainably sourced cocoa products.

Demand in Different Sectors for Cocoa Derivatives

- Food and Beverage Industry- It is the largest industry of cocoa usage for making different types of food options. It is used for making different types of cakes, cookies, ice creams, hot beverages, and baked goods. It is also used for making different types of chocolate-based beverages, further fueling the growth of the cocoa derivative market. The ingredient is also incorporated in the manufacturing of different types of functional food items, such as granola bars and protein shakes.

- Personal Care and Cosmetics- The segment is accounted to be one of the fastest growing areas of the cocoa derivative market. The ingredient is utilized for the manufacturing of products such as lotions, creams, lip balms, and body butters. The ingredient is also useful for the manufacturing of different types of hair care products, as well as due to its moisturizing properties. Anti-aging creams, face masks, and many other makeup products also involve the use of cocoa.

-

Nutraceuticals and Pharmaceuticals- Cocoa-derived flavanols are useful for targeting cardiovascular issues. Hence, it is an important ingredient for the segment. Its anti-inflammatory properties help to regulate the blood flow, which is further helpful for the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cocoa-derivative-market

New Trends of Cocoa Derivative Market

- An array of health benefits of dark chocolate is helping fuel the growth of the cocoa derivative market. Dark chocolate is beneficial for patients with health issues or people following a certain diet for weight loss.

- Environmentally sound practices and higher demand for sustainable methods to be followed are another major factor fueling the growth of the cocoa derivative industry.

- Higher demand for plant-based options and functional foods involving adaptogens, superfoods, and different types of health-promoting ingredients.

- Higher demand for premium and artisanal chocolates is another major factor for the market’s growth.

- Availability of a variety of products on various e-commerce platforms is also helpful to fuel the cocoa industry.

Recent Developments in the Cocoa Derivative Market

- In January 2025, Prefer, a Singaporean food tech startup, announced it would add cocoa-free chocolate to its bean-free product portfolio to fight the economic costs of the related sweets and products. (Source- https://www.greenqueen.com.hk)

Product Survey — Global Cocoa Derivatives Market (2024–2025)

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End-Use Sectors | Leading Brands / Producers |

| Cocoa Butter | Pale-yellow fat extracted from cocoa beans; it gives a smooth texture and aroma to chocolate and cosmetics. | Natural, deodorized, refined, organic | Chocolate production, confectionery, cosmetics, and pharmaceuticals | Barry Callebaut, Cargill, Olam, ECOM, Cémoi, JB Foods |

| Cocoa Powder | Ground residue from cocoa mass after butter extraction; used for flavor and color. | Natural, alkalized (Dutch process), low-fat, high-fat | Bakery, beverages, desserts, dairy, ice creams | Blommer, Guan Chong Cocoa, Cargill Cocoa, Olam, ECOM |

| Cocoa Liquor / Mass | Pure cocoa paste containing both cocoa solids and butter; a primary intermediate for chocolate. | Natural, alkalized, organic | Chocolate bars, coatings, fillings, and beverages | Barry Callebaut, JB Cocoa, ECOM Agroindustrial, Natra |

| Cocoa Nibs | Crushed, roasted cocoa beans; minimally processed and rich in antioxidants. | Organic, roasted, sweetened, flavored | Snacks, bakery toppings, cereals, and premium chocolate | Navitas Organics, Valrhona, Pacari, Divine Chocolate |

| Cocoa Extracts & Flavors | Concentrated liquid or powder extracts delivering cocoa flavor and aroma. | Natural extracts, liquid, spray-dried powder | Beverages, bakery, dairy, nutraceuticals | Döhler, Symrise, Givaudan, ADM, Kerry Group |

| Cocoa Shell Derivatives | Byproducts of cocoa bean shells are used for fiber and polyphenol extraction. | Fiber powder, polyphenol-rich extracts | Functional foods, dietary supplements, cosmetics | Olam Food Ingredients, Barry Callebaut, and CIRAD partners |

| Cocoa-Based Syrups & Pastes | Processed cocoa derivatives for ready-to-use flavoring and coatings. | Liquid paste, cocoa syrup, blended emulsions | Bakery fillings, desserts, beverages | Puratos, Dawn Foods, Cargill Cocoa & Chocolate |

| Cocoa-Based Nutraceutical Ingredients | High-antioxidant cocoa extracts standardized for flavanols. | Flavanol-rich powders, capsules, functional ingredients | Dietary supplements, heart health products, nutraceutical beverages | Barry Callebaut (Acticoa®), Naturex (now Givaudan), ADM |

| Compound Chocolate & Cocoa Blends | Cocoa-based blends using vegetable fats instead of cocoa butter; cost-effective chocolate alternatives. | Dark, milk, white, compound coatings | Confectionery, bakery coatings, ice cream | Cargill, Puratos, Blommer, Guittard |

| Organic & Fair-Trade Cocoa Derivatives | Certified sustainable cocoa ingredients meeting fair-trade standards. | Organic butter, powder, nibs, liquor | Premium confectionery, clean-label bakery products | Divine Chocolate, Tony’s Chocolonely, Barry Callebaut (Forever Chocolate) |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5526

Cocoa Derivative Market Dynamics

What are the Growth Drivers of the Cocoa Derivative Market?

Higher demand for cocoa derivatives for food and beverage, cosmetic, and personal care products manufacturing companies fuels its growth. Usage of the ingredient for making different food options, such as chocolates, hot beverages, cakes, cookies, and many other food options, helps to fuel the growth of the cocoa derivative market. Use of cocoa butter for the manufacturing of personal care products, such as lotions, creams, and other products, due to its moisturizing properties, also helps to fuel the growth of the market. The use of cocoa for the manufacturing of nutraceuticals and pharmaceutical products, as it is beneficial for cardiovascular issues, further fuels the growth of the market. Cocoa-based products are also highly utilized for purposes such as gifting, snacking, and using as a treat for kids.

Challenge

Issues in Cocoa Production Hampering the Market’s Growth

Cocoa production is a slow process, as it is stated that a single cocoa tree can only produce around 1kg of cocoa a year. Hence, such factors raise questions regarding sustainability, further hampering the market’s growth. Hence, such issues may slow the market’s growth and may also raise issues such as the unmet demands of the market.

Opportunity

Technology aiding the Cocoa Production is helpful for the Market’s Growth

Technological advancements in the form of AI-powered images, real-time data, hyperspectral satellite imagery, and Normalized Difference Vegetation (NDV) help to manage the complicated growth and production pattern of cocoa. Such technologically developed factors help to pay attention to cocoa tree health, productivity trends, and soil conditions. The future of the segment is also driven by factors such as sustainability, innovation, and data-driven decision making, further fueling the growth of the market. Commitment to sustainability, continuous research, and innovative technology help to manage the cocoa production and meet the increasing demands of consumers as well.

Cocoa Derivative Market Regional Analysis

Europe dominated the Cocoa Derivative Market in 2024

Europe is considered to be the world’s largest cocoa importer, and various other related products, such as cocoa paste, cocoa butter, and cocoa powder. The region is known for making multiple cocoa-derived products, such as artisanal chocolates, premium bakery products, and various other cocoa products, such as hot beverages, cakes, cookies, and baked goods. The region is also known for its different types of cocoa fusion dishes, further enhancing the growth of the market. Germany, being the second-largest producer of cocoa in the European region, makes a major contribution to the growth of the cocoa industry.

Asia Pacific is Expected to Grow in the Foreseeable Period

Asia Pacific is observed to be the fastest growing region in the foreseen period due to the higher demand for cocoa in the food and beverage industry. The region produces different types of cocoa-based food options such as baked goods, cakes, cookies, ice creams, cocoa-based hot beverages, and many other options. The region also observes the manufacturing of plant-based and artisanal cocoa-based food and beverage options, further fueling the growth of the cocoa derivative market in the foreseeable period. India produces innovative and consumer-friendly cocoa-based products, hence making a major contribution to the growth of the market in the region.

North America Is Expected to Experience Notable Growth in the Foreseeable Period

North America is observed with a notable growth in the market due to high demand for cocoa-based health-friendly food options. Dark chocolate, being healthy for heart patients and patients on a weight loss spree, also helps to contribute to the growth of the market. The market also observes growth due to high demand for plant-based cocoa options, which are highly demanded by vegans and plant-based diet followers.

Trade Analysis for the Cocoa Derivative Market

Top exporters (who supply the world)

- Côte d’Ivoire — the single largest exporter of cocoa beans by value and volume. Customs-based summaries for 2023 show exports of about 1.337 million tonnes and a value of nearly US$3.33 billion. These flows underpin the majority of physical deliveries that support benchmark futures.

- Ecuador — a leading supplier of fine and aroma cocoa varieties. 2023 customs summaries record exports valued at roughly US$1.17 billion, important for specialty grindings and higher-grade product lines.

- Ghana — a core origin whose export patterns directly influence nearby cash basis and forward curve behaviour. Ghana recorded about US$1.11 billion in exports in 2023. Recent operational disruptions have had outsized effects on short-term availability.

- Nigeria — a material West African exporter with a 2023 export value near US$670 million, supplying regional grinders and some overseas processors.

-

Cameroon — a notable regional supplier with 2023 export value around US$ 597 million and

regular shipments to Europe and Asia.

Leading exporters of cocoa beans reported at HS 1801 for 2023, therefore include Côte d’Ivoire, Ecuador, Ghana, Nigeria, and Cameroon, based on customs trade aggregates.

Top importers and demand centres

- Netherlands — the principal European import hub and a major processing and re-export centre. Reported imports from producing countries in 2023 were about 881,000 tonnes, representing roughly half of Europe’s cocoa bean imports. This concentration establishes the Netherlands as a critical physical anchor for hedging and delivery.

- Belgium — a key processing and reexport hub, with Antwerp-Bruges among the world’s largest cocoa ports.

- Germany — an important importer and grinding centre with substantial processing capacity that supports European demand.

- United States — a significant importer of beans and processed cocoa products for domestic chocolate manufacture and industrial applications. Import flows influence the price relationship between New York and European contracts.

-

Asia — regional processors and confectionery manufacturers in countries such as Malaysia, Indonesia, and Japan import beans and processed cocoa products, and affect seasonal demand patterns.

Market, Production, and Flow Notes that Affect Derivatives

- Global production and processing dynamics tightened in the 2023/24 cocoa year with ICCO reporting global production at about 4.38 million tonnes and grindings at roughly 4.82 million tonnes for that season. The supply shortfall raised nearby futures volatility and increased reliance on physical flow indicators.

- Origin operational disruptions have been material. Ghana reported a large loss of crop to smuggling in 2023/24, estimated at about 160,000 tonnes, which constrained official exportable volumes and affected local cash markets. Such unrecorded flows can reduce the effectiveness of hedges tied to official statistics.

- European port clusters and certified warehouse stocks remain leading short-term indicators of deliverable supply and basis pressure. Traders and processors monitor these flows ahead of official balance revisions.

Derivatives Market Structure and Liquidity Indicators

- Exchange venues. ICE Futures U.S. provides primary futures and options liquidity for price discovery and risk transfer by producers, merchants, and processors. European venues provide complementary liquidity and delivery structures.

- Open interest. Exchange open interest is a useful liquidity and stress indicator. Recent weekly open interest readings for ICE cocoa futures have been around 100,000 lots, a level that is material for margin planning and roll cost estimation.

Cocoa Derivative Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.2% |

| Market Size in 2025 | USD 26.59 Billion |

| Market Size in 2026 | USD 28.24 Billion |

| Market Size by 2034 | USD 45.70 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cocoa Derivative Market Segmental Analysis

Type Analysis

The cocoa powder segment led the cocoa derivative market in 2024 due to its array of multiple health benefits, such as antioxidants, flavonoids, and bioactive compounds. The ingredient is also useful for the food and beverage industry for making different types of cocoa-based food options and beverages. Cocoa powder is essential for the manufacturing of different types of cocoa-based food options, such as cakes, cookies, pastries, biscuits, hot beverages, chocolates, and many other delicious options. Hence, the segment has a major role in the growth of the market.

The cocoa butter segment is expected to grow in the foreseen period as they are natural fat derived through the hydraulic machinery, helpful for the market’s growth. It is highly utilized by the cosmetic industry due to its moisturizing, anti-aging, and antioxidant properties. Hence, the ingredient is utilized for the manufacturing of personal care and makeup products such as lotions, creams, face packs and face masks, anti-aging creams, and many other similar options. Use of cocoa butter helps in preventing aging, improving skin elasticity, maintaining moisturization, and enhancing skin tone. Hence, the segment helps in the growth of the market in the foreseeable period.

Distribution Channel Analysis

The B2B segment led the cocoa derivative market in 2024 as digitization helps in improving the overall business. The segment focuses on cocoa beans and cocoa products consisting of high-quality cocoa. Digital platforms further fuel the growth of the market in the form of cocoa trade, cocoa market, as well as allowing the cocoa manufacturers to connect with the end consumers.

The B2C segment is expected to grow in the foreseen period as the segment helps to connect cocoa manufacturers with brands and end consumers. Cocoa derivatives such as cocoa powder, cocoa butter, and chocolates are highly utilized globally in the form of artisanal and functional snacks and hot beverages, helpful for the market’s growth in the foreseeable period. Companies can sell such products to end consumers through retail and online platforms, further fueling the growth of the cocoa derivative market.

Application Analysis

The food and beverage segment led the cocoa derivative market in 2024 due to its high usage for the preparation of various food and beverage options such as cakes, cookies, biscuits, hot beverages, ice creams, and many other options. Such options are liked by consumers of all age groups, hence they further help to fuel the growth of the cocoa derivative industry. Use of cocoa for different types of plant-based food and beverage options is highly preferred by vegans and plant-based diet followers. Hence, the segment further fuels the growth of the market.

The personal care and cosmetics segment is observed to be the fastest growing in the foreseen period due to its beneficial properties, such as being anti-inflammatory, full of antioxidants and polyphenols, and also having moisturizing and anti-aging properties. Hence, it is ideal for the manufacturing of quality skin care and cosmetic products. It is highly used for the manufacturing of body lotions, creams, anti-aging creams, face masks and packs, haircare products, and many other products. Hence, the segment’s contribution is vital for the growth of the cocoa derivative market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Cocoa Derivative Market

- Olam Group Limited – Olam Group is one of the world’s leading agribusiness companies, with a strong presence across the cocoa supply chain, from bean sourcing and processing to derivative production. The company offers cocoa liquor, butter, and powder, serving confectionery, bakery, and beverage manufacturers globally. Olam focuses on sustainability, traceability, and value-added cocoa ingredients, supported by its integrated processing facilities in key producing regions.

- Natra SA – Natra specializes in the production of cocoa derivatives and chocolate products, supplying cocoa mass, cocoa butter, and cocoa powder to food manufacturers. The company is known for its European manufacturing excellence and sustainable sourcing practices, serving the premium confectionery and bakery industries.

- Cargill Inc. – Cargill is a global leader in cocoa sourcing, processing, and ingredient solutions, offering cocoa powder, butter, and liquor under its Gerkens brand. The company emphasizes innovation, sustainability, and supply chain transparency, working directly with farmers to ensure ethical and high-quality cocoa derivative production.

- Ecuakao Group Ltd. – Based in Ecuador, Ecuakao Group produces fine-flavor cocoa derivatives, including liquor, butter, and powder, sourced from high-quality Arriba Nacional cocoa beans. The company focuses on single-origin, traceable cocoa ingredients tailored for gourmet and specialty chocolate manufacturers.

- JB Foods Ltd. – JB Foods is a major cocoa processor headquartered in Singapore, producing cocoa butter, powder, and mass for global confectionery and beverage industries. Its vertically integrated operations and global distribution network enable efficient delivery of high-quality cocoa derivatives across key markets.

- Indcre SA – Indcre SA processes and exports cocoa products, including butter, cake, and powder, primarily serving the European and Latin American food industries. The company emphasizes sustainable cocoa sourcing and consistent quality, catering to chocolate, dairy, and baking manufacturers.

- United Cocoa Processor Inc. – United Cocoa Processor is a U.S.-based manufacturer specializing in cocoa liquor, cocoa butter, and cocoa powder for food and beverage producers. Its processing technology ensures high flavor retention and purity, serving specialty chocolate makers and ingredient suppliers across North America.

- Barry Callebaut AG – Barry Callebaut is the world’s largest cocoa and chocolate manufacturer, supplying cocoa derivatives and compound ingredients to confectionery, bakery, and beverage producers globally. The company leads in sustainable sourcing and product innovation, with brands such as Van Houten and Callebaut driving its extensive premium and industrial portfolios.

- Altinmarka Gida ve Tic AS – Altinmarka is a leading Turkish cocoa processor and chocolate manufacturer, producing cocoa mass, butter, and powder for domestic and international markets. Its advanced processing facilities and partnerships with global brands position it as a major player in the Middle Eastern and European cocoa derivatives sector.

- Moner Cocoa SA – Based in Spain, Moner Cocoa specializes in processing cocoa beans into butter, powder, and cake, supplying manufacturers worldwide. The company is recognized for its European quality standards, consistent flavor profiles, and sustainable supply practices, serving confectionery and beverage producers across multiple regions.

Segments Covered in the Report

By Type

- Cocoa Powder

- Cocoa Butter

- Cocoa Mass /Liquor

- Others

By Distribution

- B2B

- B2C

- Online sales

- Hypermarkets/Supermarkets

- Wholesale Stores

- Others

By Application

- Food & Beverage

- Personal care & Cosmetics

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5526

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.