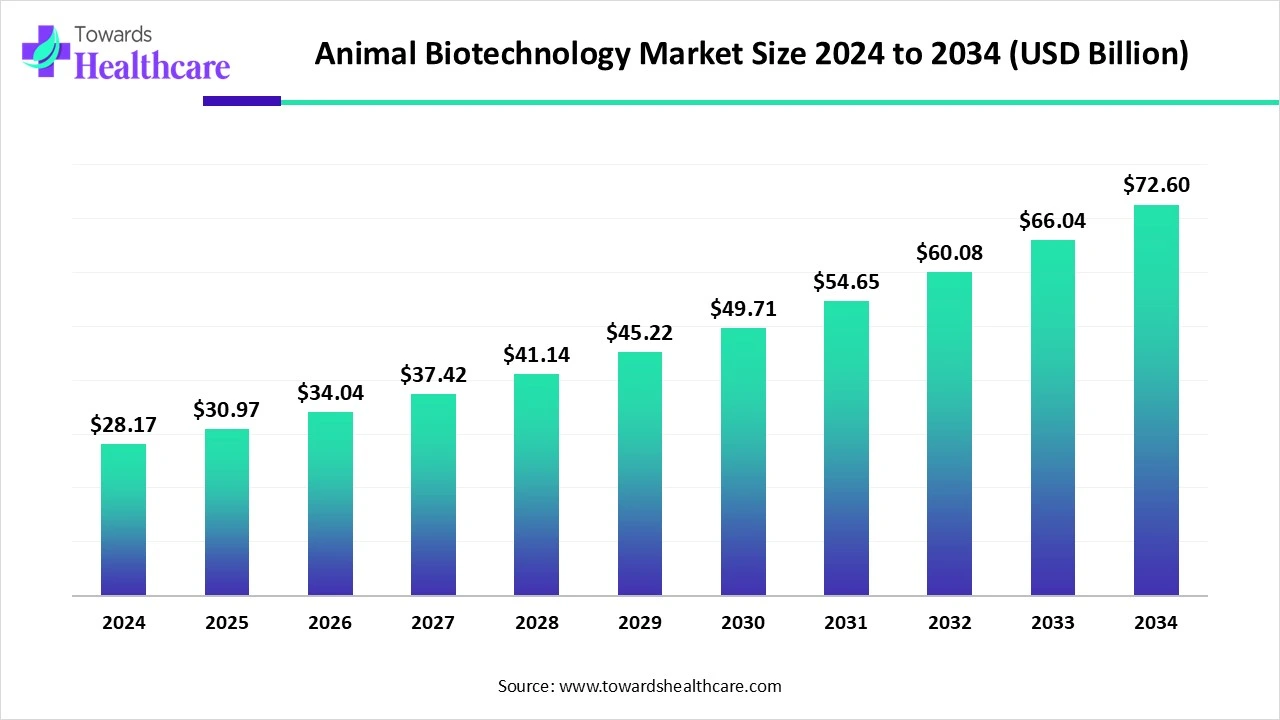

Animal Biotechnology Market Size Expected to Reach USD 72.6 Billion by 2034

The global animal biotechnology market size is calculated at USD 30.97 billion in 2025 and is expected to reach around USD 72.6 billion by 2034, growing at a CAGR of 9.93% for the forecasted period.

Ottawa, Nov. 18, 2025 (GLOBE NEWSWIRE) -- The global animal biotechnology market size was valued at USD 28.17 billion in 2024 and is predicted to hit around USD 72.6 billion by 2034, rising at a 9.93% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5849

Key Takeaways

- The animal biotechnology market will likely exceed USD 28.17 billion by 2024.

- Valuation is projected to hit USD 72.6 billion by 2034.

- Estimated to grow at a CAGR of 9.93% from 2025 to 2034.

- North America was dominant in the market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the predicted timeframe.

- By product type, the vaccines segment held the largest share of the market in 2024.

- By product type, the genetic engineering segment is expected to grow at a rapid CAGR during 2025-2034.

- By application, the animal health segment led the animal biotechnology market in 2024.

- By application, the transgenic animal research segment is expected to witness the fastest expansion in the coming years.

- By animal type, the livestock segment captured a major revenue share of the market in 2024.

- By animal type, the aquaculture segment is expected to grow rapidly in the studied years.

- By end-user, the veterinary clinics segment registered dominance in the market in 2024.

- By end-user, the biopharmaceutical companies segment is expected to be the fastest-growing during 2025-2034.

- By technology, the genetic engineering segment accounted for the largest share of the market in 2024.

- By technology, the recombinant DNA technology segment is expected to grow at a rapid CAGR in the upcoming years.

What is Animal Biotechnology?

Primarily, the global animal biotechnology market encompasses molecular biology techniques for the genetic modification of animals for optimised agricultural, pharmaceutical, and research purposes. Major growth factors involved in the market are a rise in pet and livestock ownership, accelerating demand for animal-based products, and the increasing cases of zoonotic and other animal diseases. Nowadays, researchers are exploring innovative solutions for altering genomes in farm animals and birds, evolving disease-resistant livestock, and developing animal models for studying human diseases like COVID-19.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 30.97 Billion | |

| Projected Market Size in 2034 | USD 72.6 Billion | |

| CAGR (2025 - 2034) | 9.93 | % |

| Leading Region | North America | |

| Market Segmentation | By Product Type, By Application, By Animal Type, By End User, By Technology, By Region | |

| Top Key Players | Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Bayer Animal Health (Now part of Elanco), Virbac, Vetoquinol, Idexx Laboratories, Thermo Fisher Scientific, IDEXX BioAnalytics, Genus PLC, Neogen Corporation, BioChek, Bio-Rad Laboratories, Recombinetics Inc., Trans Ova Genetics, INGENASA (Eurofins Technologies), ImmuCell Corporation, Creative Biolabs | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Significant Drivers in the Animal Biotechnology Market?

Apart from the rise in pet ownership, the global market is mainly propelled by the transforming genetic engineering, cloning, and the progression of transgenic animals, which offer optimised disease resistance, productivity, and the development of animals with expanded traits. Furthermore, the market is influenced by the widespread use of animals in drug discovery and development; along with this, transgenic animals are utilised in the production of therapeutic proteins like insulin, which stimulates market expansion.

What are the Key Drifts in the Animal Biotechnology Market?

- In June 2025, the Food and Agriculture Organization of the United Nations (FAO) and the International Centre for Genetic Engineering and Biotechnology (ICGEB) signed a new Memorandum of Understanding (MoU) to boost cooperation on genetic engineering and biotechnological solutions in support of revolutionary agrifood systems.

- In June 2025, the Governments of Canada and Saskatchewan invested $3.4 million to assist Usask's combined genomics for sustainable animal agriculture and environmental stewardship project.

What are the Developing Challenges in the Animal Biotechnology Market?

The global market faces certain limitations in its progression, including barriers in ethical and societal issues regarding genetic modification and cloning. Besides this, a need for greater expenditure in R&D and long approval processes.

Regional Analysis

What Made North America Dominant in the Market in 2024?

In 2024, North America held a major revenue share of the market. This expansion is mainly fueled by the presence of robust, technologically sophisticated veterinary facilities, research institutions, and a concentration of biotechnology companies. As well as this region is leveraging consistent innovations in genetic engineering, AI, diagnostics, and data analytics. However, in vital countries, governments are encouraging the animal biotechnology market through their significant initiatives and a conducive regulatory landscape, like the FDA's approval of genetically modified animals.

For instance,

- In April 2025, CellFE, a company in non-viral gene editing technology, collaborated with the Harbottle Lab at German Cancer Research Centre (DKFZ) and its spin-out company, TcellTech, to foster tailored cell therapy development by integrating CellFE's Ryva Mechanoporation System.

Why did the Asia Pacific Grow Significantly in the Market in 2024?

During 2025-2034, the Asia Pacific is anticipated to expand rapidly in the animal biotechnology market. Mainly, China & India are facing a huge rise in chronic diseases are supporting the introduction of novel vaccines, breakthroughs in diagnostic tools. Alongside, ASAP’s researchers are increasingly employing CRISPR-Cas9 for improving traits in farmed aquatic species, particularly pangasius, sea bass, and shrimp.

For instance,

- In December 2024, Protect Biotech, a Taiwan-based company in advanced therapies for companion animals, partnered with Rejuvenate Bio to explore novel gene therapy for canine heart disease (MMVD), which transfers anti-ageing genes to slow mitral valve degeneration in at-risk dog breeds.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Animal Biotechnology Market: Notable Efforts in 2024-2025

| Revised Livestock Health and Disease Control Programme (LHDCP) | In March 2025, it was approved with a revised program that allocates ₹3,880 crore for 2024–2026. |

| PIC, a subsidiary of Genus | In April 2025, it received approval for a line of domestic pigs with a heritable intentional genomic alteration (IGA). |

| Guidance for Intentional Genomic Alterations (IGAs) | In January 2025, the Center for Veterinary Medicine (CVM) finalised Guidance for Industry (GFI) to highlight the approval process for heritable IGAs in animals. |

Segmental Insights

By product type analysis

Which Product Type Dominated the Animal Biotechnology Market in 2024?

By capturing the biggest share, the vaccines segment led the market in 2024. Specifically, the increasing infectious and zoonotic diseases, such as avian influenza and foot-and-mouth disease, are impacting the demand. Ongoing transformations in new vaccine types (including recombinant and subunit vaccines) and optimised administration solutions, such as intranasal vaccines, are supporting the overall growth. Involvement of diverse leaders, such as Merck Animal Health, is widely using RNA particle technology for the development of custom, herd-specific vaccines.

Whereas the genetic engineering segment is estimated to register rapid expansion in the coming era. The rising demand for genetically modified animals in the production of large-scale pharmaceuticals is assisting in raising product quality and effectiveness. Although in vitro fertilisation is also utilised for rare genetic traits, and is complemented by gene editing and genomic analysis for animal health and production. The emergence of gene-edited animals for food production and the establishment of new diagnostic kits for animal diseases are also impacting the ultimate expansion.

By application analysis

How did the Animal Health Segment Lead the Market in 2024?

The animal health segment held a dominant share of the animal biotechnology market in 2024. A rise in diseases in both livestock and companion animals, the increasing demand for protein-based products, and accelerated public concern for animal welfare are driving the segmental growth. Nowadays, the globe is facing an increase in the prevalence of African Swine Fever (ASF), Avian Influenza (AI), and Lumpy Skin Disease (LSD).

The transgenic animal research segment will expand rapidly during 2025-2034. A prominent benefit of these animals, particularly mice, is crucial in the study of gene function and the development of animal models of human diseases, such as cancer and other chronic conditions. The adoption of modifying dairy composition is supporting lowering allergens or accelerating nutritional value, and editing genes, especially myostatin, in boosting muscle mass in livestock and fish.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By animal type analysis

Which Animal Type Led the Animal Biotechnology Market in 2024?

In 2024, the livestock segment registered dominance with a major share of the market. The worldwide increasing demand for animal-derived products, including meat and dairy, and the requirement to combat disease through genetic and technological breakthroughs, are escalating the adoption of these kinds of animals. Ongoing advancements in Precision Livestock Farming (PLF) with AI and wearables, as well as a broader use of CRISPR-Cas9, are impacting the market development.

The aquaculture segment is anticipated to witness the fastest growth in the predicted timeframe. A crucial catalyst is the growing awareness regarding seafood's nutritional benefits (like protein and omega-3s), with expanded emphasis on more sustainable, efficient, and resilient seafood production is fostering the segmental growth. The recent research milestone has bolstered the accelerated omega-3 fatty acid levels in fish by editing the elovl2 gene, enhancing their nutritional value.

By end-user analysis

What Made the Veterinary Clinics Segment Dominant in the Market in 2024?

In 2024, the veterinary clinics segment held the largest share of the animal biotechnology market. They are promoting the wider integration of AI for diagnostics and administrative tasks, with improved application of portable and advanced imaging, especially MRI and ultrasound. Additionally, consistent digitalisation is also assisting the expansion of telehealth and the broader adoption of big data for better treatment plans.

On the other hand, the biopharmaceutical companies segment will expand rapidly. Day by day, the world is emphasising genetic engineering and precision medicine, with escalated R&D investment is majorly supporting these companies to adopt innovative animal biotechnology solutions. The emerging developments are boosting genetic and reproductive technologies for rapid development frequencies, with optimisations in diagnostics and newer hybrid platforms, which include the integration of multiple technologies, like RNA particles and adjuvants.

By technology analysis

Which Technology Held a Major Share of the Animal Biotechnology Market in 2024?

The genetic engineering segment was dominant in the market in 2024. An eventual adoption of this technology is increasingly employed for evolving animals that are more resistant to diseases, which further minimises the need for antibiotics and reduces treatment expenditures. Moreover, the latest study has described that the deletion of the CD163 gene in pigs makes them resistant to the Porcine Reproductive and Respiratory Syndrome virus (PRRSV).

Although the recombinant DNA technology segment is predicted to expand fastest. The widespread incorporation of self-amplifying RNA (saRNA) synthesis, innovative cancer treatments targeting specific genetic mutations, and the rising combination of AI into protein design are influencing the comprehensive technological advances. Alongside, it is exploring expanded biopharmaceutical production and simplified regulatory pathways for specific gene-edited products.

Browse More Insights of Towards Healthcare:

The global animal genetics market size is calculated at USD 6.51 billion in 2024, grew to USD 6.93 billion in 2025, and is projected to reach around USD 12.11 billion by 2034. The market is expanding at a CAGR of 6.4% between 2025 and 2034.

The global animal model market size is calculated at USD 2.54 billion in 2024, grew to USD 2.76 billion in 2025, and is projected to reach around USD 5.81 billion by 2034. The market is expanding at a CAGR of 8.64% between 2025 and 2034.

The global animal vaccine market size is anticipated to grow from USD 18.98 billion in 2025 to USD 44.77 billion by 2034, with a compound annual growth rate (CAGR) of 10% during the forecast period from 2025 to 2034, as a result of a rising focus on food safety and security.

The global companion animal health market size is calculated at US$ 25.28 in 2024, grew to US$ 27.64 billion in 2025, and is projected to reach around US$ 61.74 billion by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

The global monoclonal antibodies in veterinary health market size is calculated at US$ 1.23 in 2024, grew to US$ 1.45 billion in 2025, and is projected to reach around US$ 6 billion by 2034. The market is expanding at a CAGR of 17.13% between 2025 and 2034.

What are the Latest Developments in the Animal Biotechnology Market?

- In October 2025, the MBOLD coalition launched the Protein Catalyst, a pre-competitive, collaborative effort developed to propel innovation and support sustainable addressing the world's quickly increasing appetite for high-quality proteins.

- In May 2025, Texas A&M AgriLife Research and the Texas A&M University System unveiled a new state-of-the-art Animal Reproductive Biotechnology Centre.

- In May 2025, KROMATID, a player in structural genomics innovation, announced its boosted capability for its Advanced Cytogenetics Platform, KROMASURE PinPoint, to facilitate a proprietary high-throughput solution.

Animal Biotechnology Market Key Players List

- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- Ceva Santé Animale

- Bayer Animal Health (Now part of Elanco)

- Virbac

- Vetoquinol

- Idexx Laboratories

- Thermo Fisher Scientific

- IDEXX BioAnalytics

- Genus PLC

- Neogen Corporation

- BioChek

- Bio-Rad Laboratories

- Recombinetics Inc.

- Trans Ova Genetics

- INGENASA (Eurofins Technologies)

- ImmuCell Corporation

- Creative Biolabs

Segments Covered in the Report

By Product Type

- Vaccines

- Live Attenuated

- Inactivated

- DNA Vaccines

- Recombinant Vaccines

- Diagnostics

- Immunodiagnostics (ELISA, lateral flow)

- Molecular Diagnostics (PCR, qPCR)

- Biosensors

- Therapeutics

- Monoclonal Antibodies

- Recombinant Proteins

- Genetic Engineering

- Transgenic Animals

- Gene Editing Tools (CRISPR, TALEN)

- Reproductive Technologies

- Artificial Insemination

- Embryo Transfer

- In Vitro Fertilization (IVF)

- Nutrition-Based Biotechnology

- Probiotics

- Enzymes

- Nutritional Genomics

By Application

- Animal Health

- Animal Breeding & Reproduction

- Genomics & Proteomics

- Transgenic Animal Research

- Drug Production (Biopharming)

By Animal Type

- Livestock (Cattle, Sheep, Pigs)

- Poultry (Chickens, Turkeys)

- Companion Animals (Dogs, Cats)

- Aquaculture (Fish, Shrimp)

- Other (Horses, Rabbits)

By End User

- Veterinary Clinics

- Animal Research Institutes

- Biopharmaceutical Companies

- Livestock Farms

- Academic & Government Institutions

By Technology

- Genetic Engineering

- Cloning

- Cell Culture

- Recombinant DNA Technology

- Artificial Insemination

- PCR/NGS-based Diagnostics

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5849

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.