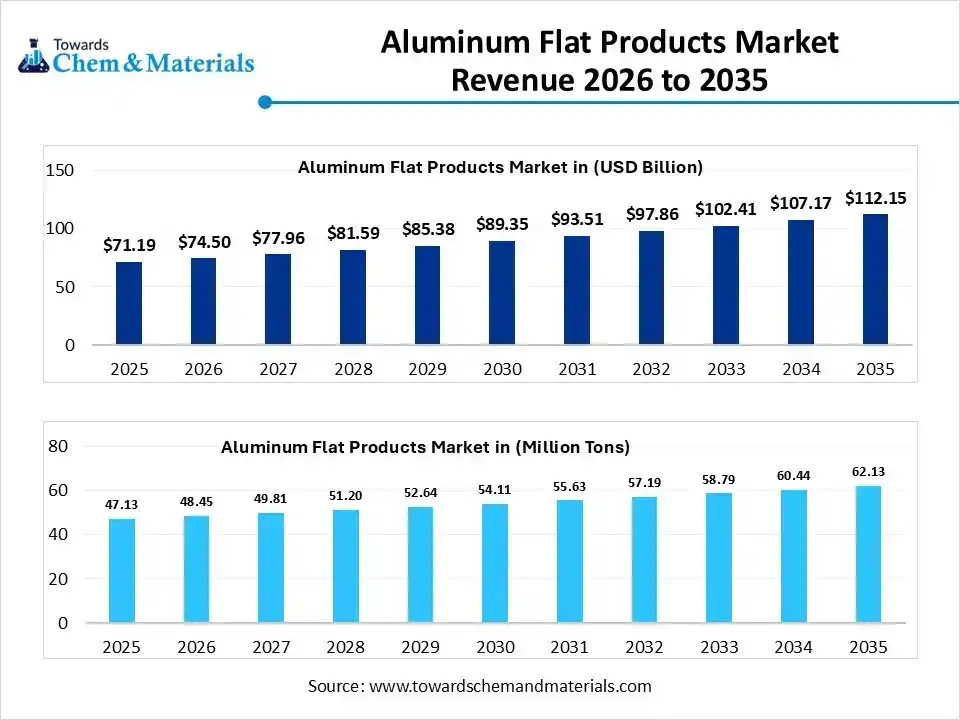

Aluminum Flat Products Market Volume Worth 62.13 Million Tons by 2035

According to Towards Chemical and Materials, the global aluminum flat products market volume was valued at 47.13 million tons in 2025 and is expected to be worth around 62.13 million tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 2.80% over the forecast period from 2026 to 2035.

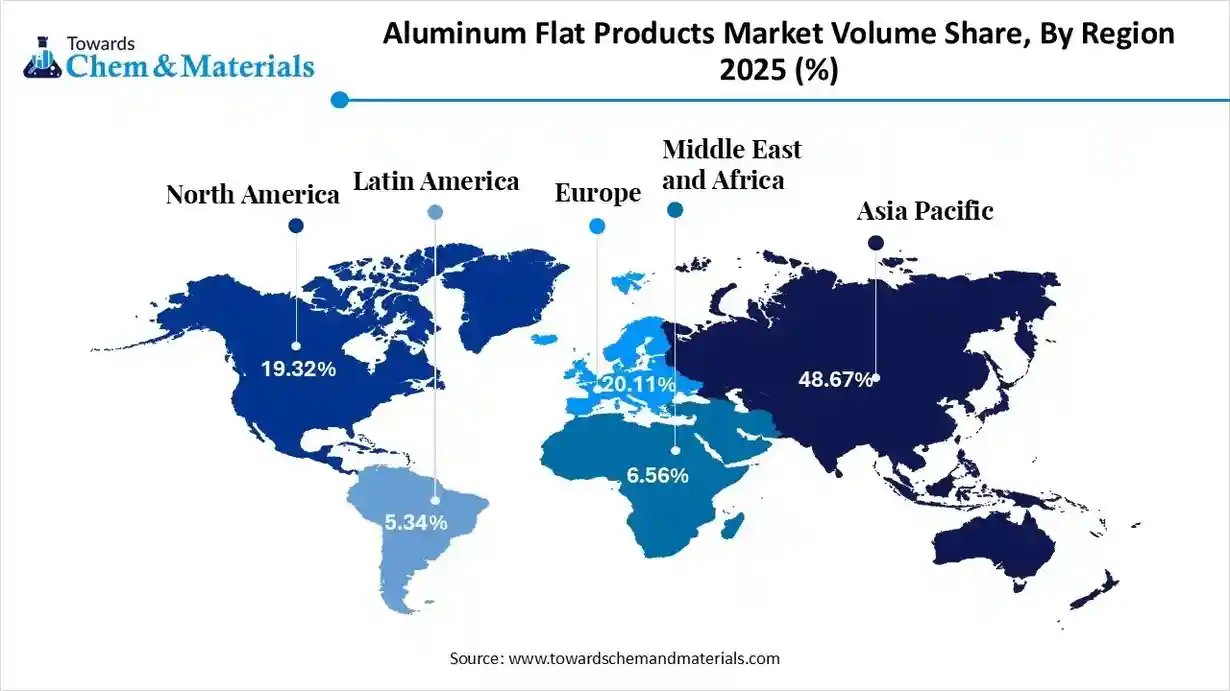

Ottawa, Jan. 22, 2026 (GLOBE NEWSWIRE) -- The global aluminum flat products market size was estimated at USD 71.19 billion in 2025 and is expected to increase from USD 74.50 billion in 2026 to USD 112.15 billion by 2035, growing at a CAGR of 4.65% from 2026 to 2035. In terms of volume, the market is projected to grow from 47.13 million tons in 2025 to 62.13 million tons by 2035. growing at a CAGR of 2.80% from 2026 to 2035. Asia Pacific dominated the aluminum flat products market with the largest volume share of 48.6% in 2025. The market is driven by rising demand for lightweight, corrosion-resistant materials, sustainability & recycling initiatives, technological advancements, and industrial applications. A study published by Towards Chemical and Materials, a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6137

What are Aluminum Flat Products?

The aluminum flat products are characterized by a carbon intensity score and integration of inert anode technology and renewable -powered smelting that turned aluminum flat products into net-zero carbon targets. By utilizing AI-driven closed-loop recycling that creates circular material flow to reduce the environmental impact of electric vehicles and premium consumer goods, that driving their demand.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Aluminum Flat Products Market Report Highlights

- The Asia Pacific dominated the global aluminum flat products market with the largest volume share of 48.6% in 2025.

- The aluminum flat products market in North America is expected to grow at a substantial CAGR of 3.86% from 2026 to 2035.

- The Europe aluminum flat products market segment accounted for the major volume share of 20.11% in 2025.

- By product type, the Sheets [0.2 - 0.6 mm] segment dominated the market and accounted for the largest volume share of 29.11% in 2025.

- By product type, the plates segment is expected to grow at the fastest CAGR of 4.17% from 2026 to 2035.

- By alloy series, the 3xxx series segment led the market with the largest revenue volume share of 34.2% in 2025.

- By processing, the cold rolling segment dominated the market and accounted for the largest volume share of 58.8% in 2025.

- By end-use industry, the packaging segment led the market with the largest revenue volume share of 39.4% in 2025.

Private Industry Investments for Aluminum Flat Products:

- Hindalco Industries/Novelis Hindalco, through its subsidiary Novelis, is the world's largest aluminum rolling and recycling company, focusing on high-end flat-rolled products for automotive and packaging applications.

- Shyam Metalics & Energy The company is investing INR 450 crore in a new greenfield plant in Odisha to produce 60,000 tonnes per year of aluminum flat-rolled products, particularly for the electric vehicle (EV) segment.

- Constellium This company specializes in high-value-added aluminum solutions for aerospace, automotive, and packaging applications, particularly in the European market.

- Assan Alüminyum A major Turkish producer of flat-rolled aluminum, Assan is investing over $100 million in continuous casting capacity expansion and also plans to open a facility in the United States with an investment of $460 million.

- UACJ Corporation This Japanese-based group is a major producer with several manufacturing sites across the globe, supplying a high volume of can stock and other flat-rolled products to meet global demand.

- Vedanta Aluminium Vedanta is planning to invest ₹13,226 crore to ramp up its overall aluminum capacity to 3.1 million tonnes per annum by FY28, with a focus on value-added products for India's growing infrastructure, automotive, and EV sectors.

Aluminum Flat Products Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 74.50 Billion / 48.45 Million Tons |

| Revenue Forecast in 2035 | USD 112.15 Billion / 62.13 Million Tons |

| Growth rate | CAGR 4.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | Product Type, By Alloy Series, By Processing Technology, By End-Use Industry, By Region |

| Key companies profiled | Novelis Inc., Alcoa Corporation, Norsk Hydro ASA, Constellium SE, Alcoa Corporation, Norsk Hydro ASA, Constellium SE, Novelis Inc., Arconic Corporation, UACJ Corporation, United Company RUSAL, Speira GmbH |

What Are Major Trends in the Aluminum Flat Products Market?

- Plastic-to-Aluminum Substitution: The major shift from single-use plastics to recyclable aluminum can and foil in the packaging sectors is supported by sustainable goals.

- Decarbonization Goals: The manufacturers focus on green aluminum initiatives by fueling their energy-intensive production with renewable sources to push towards carbon neutrality goals across the supply chain.

- Expanded Recycling Infrastructure: The increasing trend towards expanding recycling capacity and implementing advanced sorting and purification technologies that reduce carbon emissions.

- Automotive Lightweighting: The push for fuel-efficient vehicles and the expansion of EV production is driving aluminum FRP in body structures, panels, and battery enclosures to reduce weight and improve EV battery range.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Aluminum Flat Products Market Dynamics

Driver

The market is mainly driven by the circular economy model due to the infinite recyclability of aluminum. The industrial focus on reducing landfill waste and conserving natural resources to reuse without material degradation is supported by global sustainability mandates.

Restraint

The aluminum as a material faces strong competition from other alternative materials like high-strength steel, magnesium alloys, and carbon fibers, which offer comparable performance, with the same strength-to-weight ratio in various applications, significantly limiting aluminum flat products.

Opportunity

The global transition to renewable energy infrastructure offers a major market opportunity because aluminum is used in solar panel frames and wind turbine components due to its superior durability and corrosion resistance, that driving investment in developing supply chains to support renewable energy projects to meet demand for high-performance aluminum in the market.

How is the Autonomous Warehouse concept being applied to flat product logistics?

The AI-driven Automated Guided Vehicles and AI-directed cranes optimized the storage layout based on shipping schedules to make coils accessible. By integrating with advanced technologies like autonomous mobile robots and real-time data processing reduces re-handling damage and improve speed of global distribution and supply chain, enhancing market expansion.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6137

Aluminum Flat Products Market Segmentation Insights

Product Type Insights

How did the Sheets Segment dominate the Aluminum Flat Products Market in 2025?

The sheets [0.2 - 0.6 mm] maintain their dominance in the market, valued for their versatility across industries like packaging, automotive, and construction. Demand driven by packaging's lightweight, recyclable solutions, and automotive use in vehicle bodies' structural components to improve fuel efficiency. Construction also uses aluminum sheets in roofing and siding, and other building applications.

The plates segment is anticipated to grow fastest in the market during the forecast period, driven by their high strength and durability, especially in aerospace vessels, airframe components in defence, and battery enclosures of electric vehicles. The Investments in renewable energy and industrial machinery further boost demand for making plates that offer superior dimensional stability and corrosion resistance, driving market expansion.

Alloy Series Insights

Why did the 3xxx Series Segment hold the biggest share in the Aluminum Flat Products Market?

The 3xxx series dominated the market by offering an ideal blend of moderate strength, excellent formability, and superior corrosion resistance, making it the most versatile and cost-effective alloy for fabrication. The demand in packaging, where high-volume production of beverage cans and food packaging that offer high performance and fast manufacturing, along with extensive construction applications in roofing, gutter systems, HVAC systems, and reliable heat exchangers, where workability and thermal properties are necessary.

The 6xxx series segment is experiencing the fastest growth in the market during the projected period. Driven by its unique heat treatment for high strength and superior corrosion resistance. This alloy series is preferred for the automotive industry’s transition to electric mobility for lightweight structural components and body panels, as well as in modern construction and renewable energy durable solar mounting systems. Additionally, the 6xxx series is highly compatible offer structural integrity and environmental durability.

Processing Insights

Which Processing Segment Dominates the Aluminum Flat Products Market in 2025?

The cold rolling dominates the market, driven by its precise dimensions, thin gauges, and superior surface finishes essential for electronics and architecture. This process induces work hardening that produces stronger, more durable aluminum and supports the industry shift toward down-gauging to reduce weight and producing high-quality, high-tolerance aluminum sheets and strips.

The continuous casting segment is emerging as the fastest-growing process in the market, offering efficiency and sustainability by reducing energy consumption and emissions through a streamlined liquid-to-strip approach. It produces high-quality coils with shorter lead times and cost-effectivity, crucial in packaging and building materials, supporting industry decarbonization and lean manufacturing with a smaller environmental footprint.

End-Use Industry Insights

How did the Packaging Segment Dominate the Aluminum Flat Products Market?

The packaging segment dominates the market, driven by the combination of impermeable barriers with recyclability. The material barrier properties and formability enable its leadership due to sustainability, high performance, and economic efficiency, which seamlessly meet consumer and regulatory demands.

The automotive and transportation segment offers significant growth during the projected period, fueled by the shift towards electric mobility and lightweighting. Aluminum is crucial for high-strength body panels, crash-resistant chassis, and battery enclosures, offering superior crash protection and thermal conductivity. Additionally, expanding demand from rail and aerospace sectors and transition toward sustainable transport align with Stricter emission standand make this segment grow rapidly.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6137

Regional Insights

How did Asia Pacific Dominate the Aluminum Flat Products Market?

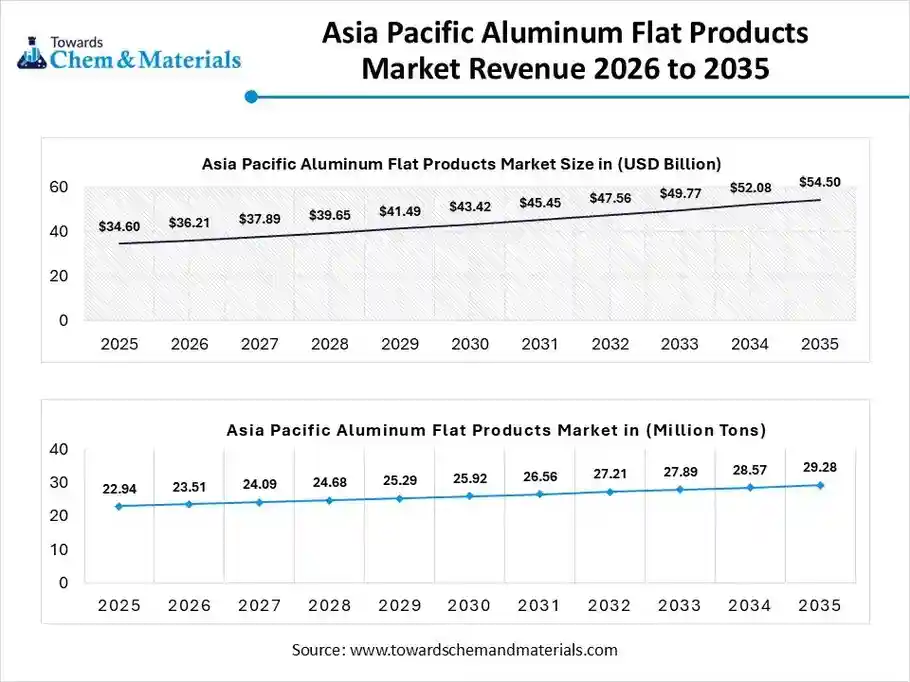

The Asia Pacific aluminum flat products market size was valued at USD 34.60 billion in 2025 and is expected to be worth around USD 54.50 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.68% over the forecast period from 2026 to 2035. the aluminum flat products market volume was estimated at 22.94 million tons in 2025 and is projected to reach 29.28 million tons by 2035, growing at a CAGR of 7.75% from 2026 to 2035. Asia Pacific dominates with 48.6% market volume share in 2025, led by industrial, automotive production, and infrastructure development to sustain its lead.

The Asia-Pacific region leads the global market as the main hub for production and industrial consumption, driven by massive manufacturing infrastructure growth and industrialization that increases demand for architectural aluminum. It is also a key center for electric vehicle and electronics manufacturing, relying on precision -rolled sheets for battery systems and high-tech parts. With integrated supply chains and large domestic smelting capacity, it remains the leader in market growth.

China Aluminum Flat Products Market Trends

China's market is expanding steadily with strong domestic demand driven by construction, automotive, packaging, and industrial applications that increasingly favor lightweight, corrosion-resistant materials. China holds a dominant position in global production and consumption of aluminum flat rolled products, supported by robust industrial infrastructure and government policies that encourage capacity scaling and technological upgrades.

Why is North America the Fastest-Growing Region in the Aluminum Flat Products Industry?

North America is emerging as a high-growth market due to a shift toward domestic manufacturing and green reindustrialization. Growth is driven by expanding electric vehicle supply chains, local production of battery enclosures, and government incentives for clean energy infrastructure, accelerating demand in solar arrays and energy-efficient building systems. The recovery of aerospace and a transition to recyclable packaging materials are further supporting regional expansion.

Canada Aluminum Flat Products Market Trends

Canada's market is growing steadily, supported by demand from automotive, construction, packaging, and aerospace sectors that value aluminum's lightweight and corrosion-resistant properties. The country benefits from a strong upstream aluminum industry and reliable access to low-carbon power, which enhances competitiveness in flat-rolled production.

More Insights in Towards Chemical and Materials:

- Aluminum Metal Powder Market Size to Hit USD 4.15 Billion by 2035

- Aluminum Extrusion Market Size to Surpass USD 224.18 Bn by 2035

- Aluminum Casting Market Size to Surpass USD 172.05 Bn by 2035

- Specialty Alumina Market Size to Reach USD 11.12 Billion by 2034

- Aluminum Composite Materials Market Size to Reach USD 8.18 Billion by 2034

- Aluminum Foil Market Size to Reach USD 48.46 Billion by 2034

- Aluminum Trihydrate (ATH) Market Volume to Hit 4653.45 Kilo Tons by 2034

- Aluminum Oxide Market Volume to Hit 215.45 Million Tons by 2034

- Biaxially Oriented Polypropylene (BOPP) Market Size to Hit USD 224.40 Billion by 2035

- North America Crop Protection Chemicals Market Size to Hit USD 23.20 Billion by 2035

- Cathode Materials Market Size to Hit USD 115.04 Billion by 2035

- Renewable Diesel Market Size to Hit USD 60.43 Billion by 2035

- Steel Wire Rope Market Size to Hit USD 19.79 Bn by 2035

- Bio-polyols Market Size to Hit USD 21.47 Bn by 2035

- Asia Pacific Polymer Foam Market Size to Hit USD 131.7 Bn by 2035

- Lay-up Composites Market Size to Hit USD 120.15 Bn by 2035

- PAN-based Carbon Fiber Market Size to Hit USD 10.16 Bn by 2035

- Polyhydroxyalkanoate (PHA) Market Size to Hit USD 586.98 Mn by 2035

- Performance Chemicals Market Size to Hit USD 582.98 Billion by 2035

- Standard Modulus Carbon Fiber Market Size to Hit USD 7.56 Bn by 2035

- Sustainable Feedstock Market Size to Hit USD 151.71 Bn by 2035

- Lead Acid Battery Recycling Market Size to Hit USD 33.24 Bn by 2035

- Monoethylene Glycol Market Size to Hit USD 44.18 Billion by 2035

- Organosilicon Polymers Market Size to Hit USD 29.88 Bn by 2035

-

Magnesium Powder Market Size to Hit USD 667.14 Million by 2035

Recent Breakthroughs in the Aluminum Flat Products Industry

- In December 2025, SeAH Aerospace and Defense announced an agreement with Boeing, known as the largest aircraft manufacturer. The agreement is planned to supply high-strength aluminum alloy materials used in fuselages and aircraft wings to accelerate market expansion and improve profitability.

https://www.seah.co.kr/eng/pr/detail-page?idx=435

Top Market Players in the Aluminum Flat Products Market & Their Offerings:

- Alcoa Corporation: A major upstream producer focused on bauxite mining and smelting that provides high-quality cast slabs and plates for global industrial use.

- UACJ Corporation: A premier Japanese manufacturer specializing in high-precision flat-rolled products, including beverage can stock and automotive body panels.

- Norsk Hydro ASA: A Norwegian energy and aluminum firm known for producing low-carbon sheet ingots and recycled flat products for the construction and transport sectors.

- United Company RUSAL: One of the world’s largest primary aluminum producers, utilizing hydroelectric power to manufacture low-carbon rolling slabs and high-purity plates.

- Speira GmbH: A European rolling and recycling specialist that produces advanced aluminum coils, sheets, and strips for the packaging and automotive industries.

- Constellium SE: A global leader in high-value solutions, manufacturing specialized aluminum sheets and plates for aerospace airframes and automotive structures.

- Novelis Inc.: The world’s largest aluminum recycler and producer of flat-rolled products, dominating the sustainable sheet market for beverage cans and vehicles.

- Arconic Corporation: A leading provider of engineered aluminum sheet and plate designed for high-performance applications in the North American automotive and aerospace markets.

Aluminum Flat Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Aluminum Flat Products Market

By Product Type

- Sheets (0.2 mm to 6 mm)

- Plates (Greater than 6 mm)

- Foils (Less than 0.2 mm)

- Foil Stock

- Can Stock

- Circles and Slugs

- Tread and Embossed Plates

By Alloy Series

- 1xxx Series (Pure Aluminium)

- 2xxx Series (Al-Cu Alloys)

- 3xxx Series (Al-Mn Alloys)

- 4xxx Series (Al-Si Alloys)

- 5xxx Series (Al-Mg Alloys)

- 6xxx Series (Al-Mg-Si Alloys)

- 7xxx Series (Al-Zn Alloys)

- 8xxx Series (Al-Li and Other Alloys)

By Processing Technology

- Hot Rolling

- Cold Rolling

- Continuous Casting

By End-Use Industry

- Packaging

- Automotive and Transportation

- Building and Construction

- Aerospace and Defense

- Electrical and Electronics

- Industrial Machinery

- Marine

- Consumer Durables

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6137

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.